Examining the Surge in Small Business Optimism: A Closer Look at the August Trends

In recent months, small businesses have experienced an encouraging uptick in confidence, as highlighted by the National Federation of Independent Business (NFIB) survey. The latest report shows that the Small Business Optimism Index climbed slightly in August, pointing to a period of cautious optimism despite several tricky parts that continue to affect business operations. This opinion piece digs into the critical survey outcomes, the tangled issues that still persist, and the implications for small business owners as they strive to find their path in today’s ever-changing economic conditions.

While some data provide a hopeful glance at business recovery, others highlight ongoing challenges like labor quality concerns and the continuing impact of supply chain disruptions. In this editorial, we take a closer look at each significant facet of the NFIB survey, discussing the survey’s key findings, the hidden complexities that lie beneath, and the essential actions that industry leaders might consider to solidify their operations.

Understanding the Rising Small Business Optimism Index

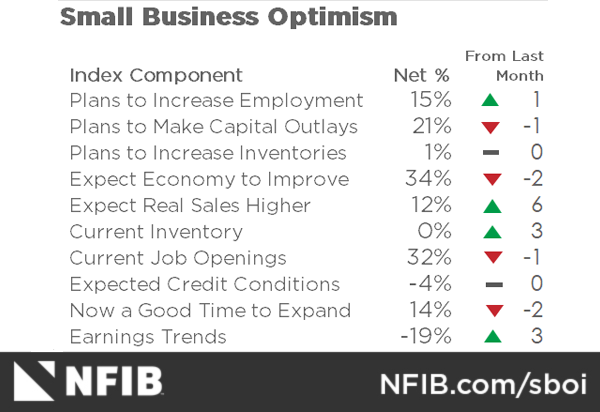

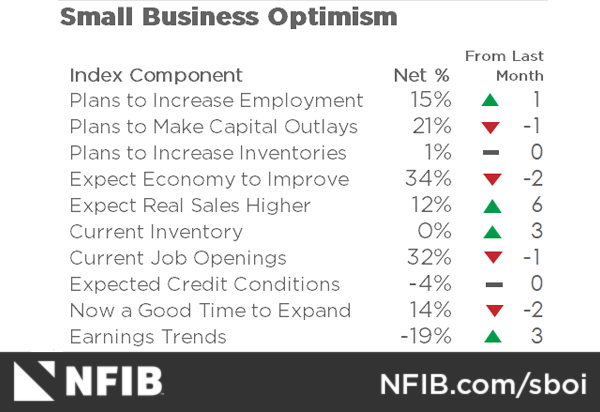

The Small Business Optimism Index edged upward by 0.5 points in August, settling at 100.8. This figure is nearly 3 points above the 52-year average of 98, demonstrating an overall positive shift in business sentiment. Although the improvement may seem minimal at first glance, it is indicative of an evolving business landscape where owners are increasingly confident about their sales expectations and earnings.

NFIB Chief Economist Bill Dunkelberg noted that a greater number of business owners reported enhancements in expected sales and profits. However, he also pointed out that challenges related to labor quality continue to be a pressing problem—the one major issue that persists on Main Street.

Key Takeaways from the Optimism Increase

A few aspects of this optimism rise merit special attention:

- Sales and Earnings Expectations: More owners are forecasting better sales performance and improved earnings. This signals that despite the confusing bits of the market, there is a buoyant outlook among those running businesses.

- Labor Quality Challenges: Even with improved sales projections, labor quality remains at the forefront of concerns. Many owners are still dealing with the off-putting task of sourcing reliable, skilled labor.

- Financial and Capital Expenditures Outlook: The survey noted shifts in financing expectations and capital expenditure plans, which will be discussed further in subsequent sections.

Decoding the Decline in Uncertainty

Alongside rising optimism, the NFIB survey highlighted a reduction in the Uncertainty Index by 4 points, now placing it at 93. Although this downward shift is promising, the index remains above its historical average, underscoring that many small business owners are still facing nerve-racking, unpredictable market conditions.

The survey attributes the decline primarily to a more optimistic view on financing expectations and planned capital expenditures. Businesses appear to be less anxious about securing credit and investing in necessary upgrades—a sign that the economy might be stabilizing for small players.

Why the Uncertainty Index Matters

For small business owners, the tilt of the Uncertainty Index is a critical metric. Here are some of the reasons why:

- Planning for the Future: A lower uncertainty score means that business owners feel more confident about making long-term plans and executing capital improvements.

- Access to Financing: With financing hurdles becoming less intimidating, companies are more likely to invest in new technologies and expansion projects.

- Operational Stability: Reduced uncertainty often translates to steadier day-to-day operations, which is essential in an economy that is often full of problems and riddled with tension.

Tackling the Labor Quality Conundrum

One of the most frequently mentioned concerns by small business owners is the struggle to recruit and retain high-quality employees. The NFIB’s August data indicates that 32% of all small business owners reported that there were job openings they could not fill—an increase that reflects the ongoing challenges in the labor market.

The difficulty in hiring is not just about numbers; it is about finding the right applicants. As 81% of hiring businesses reported receiving few or no qualified applications, the fine points of labor quality and workforce management remain a top priority.

Understanding the Labor Quality Challenge

The labor market presents several nerve-wracking, complicated pieces that small businesses must figure a path through:

- Staff Shortages: A significant portion of small business owners are struggling to find qualified candidates, directly impacting their ability to expand.

- Rising Compensation Demands: With a net 29% of owners reporting recent compensation increases and 20% planning future raises, the challenge of balancing labor costs while remaining competitive becomes even more intimidating.

- Quality Over Quantity: The task of sifting through a flood of applications to locate talent that meets the specific needs of a business is both time-consuming and overwhelming.

Table: Key Labor Market Indicators

| Indicator | August Data | July Comparison |

|---|---|---|

| Unfilled Job Openings | 32% | Down by 1 point |

| Owners Raising Compensation (Net) | 29% | Up by 2 points |

| Planned Compensation Raises (Next 3 Months, Net) | 20% | Up by 3 points |

These statistics provide a clear snapshot of the current challenges in the labor market. If nothing else, they serve as a reminder that while optimism may be on the rise, the job market’s complicated pieces still require creative solutions and targeted strategies.

Financing Expectations and Capital Expenditures: The Business Investment Outlook

Another notable aspect of the NFIB survey revolves around financing expectations and capital expenditures. A decrease in uncertainty regarding these matters was a significant factor behind the drop in the overall Uncertainty Index. This development is indicative of a growing willingness among small business owners to consider investing in their futures.

While business confidence is building, many owners have to contend with a host of intimidating factors when it comes to planning for capital outlays. Despite these nerve-wracking considerations, the fact that 56% of small business owners reported having made capital expenditures in the past six months is a promising sign. Such investments are essential for the long-term growth and competitiveness of businesses.

The Investment Conundrum: Opportunities and Risks

Business owners are carefully weighing several elements before making investment decisions. Getting into the financial nitty-gritty, the following considerations are especially important:

- Cost-Benefit Analysis: Determining whether the potential return on investment outweighs the immediate costs remains a super important challenge.

- Market Volatility: The current economic climate, although showing signs of improvement, still retains several overwhelming twists and turns that can impact the success of any investment.

- Future Financing Potential: With financing expectations showing some improvement, businesses may feel more secure in their ability to secure loans or lines of credit when needed.

Even as these factors complicate decision-making, it is evident that many small business owners continue to be proactive in taking the wheel on their own growth. By carefully weighing risks and opportunities, they are finding their way through a tangled mix of stimulating yet challenging market developments.

Supply Chain Disruptions: Easing Yet Still a Concern

For several years, disruptions in the supply chain have been a scary and overwhelming challenge for small businesses. While recent data shows that the percentage of owners affected by supply chain issues has reduced by 10 points since July, more than half of the respondents still indicated that these disruptions continue to influence their operations.

The gradual easing of these supply chain problems is a welcome change for many small business owners. However, it does not negate the fact that persistent issues related to delays, inventory shortages, and rising prices for essential components still need careful attention.

Breaking Down the Supply Chain Challenge

To fully understand the impact of supply chain issues, it helps to consider the following aspects:

- Inventory Management: Delays in the supply chain require businesses to build and manage larger inventories, which can be both costly and risky.

- Cost Pressures: Rising costs related to disrupted supply chains directly affect profit margins and overall business sustainability.

- Customer Fulfillment: Reliable and timely delivery of products or services is critical, which is why any disruption can be particularly detrimental.

Addressing these challenges usually means rethinking operational strategies and investing in more resilient systems. In many cases, small businesses are turning to technology and alternative logistics solutions to figure a path through the tricky parts of modern supply chain management.

Inflation and Price Adjustments: A Balancing Act

Inflation continues to be an essential, yet complicated topic for small business owners. According to the survey, 11% of owners singled out inflation—or higher input costs—as the primary stumbling block in their operations. Although the net percentage planning to raise average selling prices fell to 21%, it remains the lowest reading so far this year.

The reduced willingness to raise prices suggests that businesses are trying to balance increased operational costs with the potential for losing customers. This balancing act touches on several tricky parts:

- Customer Sensitivity: A notable number of consumers are highly sensitive to even the smallest price hike, making it difficult for owners to pass on higher costs.

- Competitive Market Pressures: With the competitive landscape constantly shifting, small business owners have to be cautious about making any moves that might alienate their customer base.

- Long-Term Sustainability: While raising prices might counter short-term cost increases, it is essential to do so in a measured way that ensures long-term sustainability.

As the market navigates through these slight differences in pricing strategy, business owners are seeking ways to offset rising costs without compromising their competitive edge. Using technology, improving operational efficiencies, and exploring alternative suppliers are just a few of the strategies being employed.

Taxation and Government Regulations: Challenges on the Regulatory Front

Government regulations and tax policies remain a significant source of concern for small business owners. The survey reveals that 17% of owners cited taxes as their single most important problem, with an additional 9% pointing to government regulations and red tape. These factors continue to pose a set of overwhelming challenges in an already tense economic environment.

When government policies are involved, business owners must contend with a host of overwhelming and confusing bits. In some cases, the regulatory framework not only increases operational costs but also impedes the ability to grow and innovate.

Key Issues with Taxation and Regulations

Some of the super important issues arising from taxation and regulatory policies include:

- Compliance Costs: Meeting regulatory requirements often involves significant expenditures of time and money, which can strain already limited resources.

- Operational Inefficiencies: Complex rules can lead to delays and inefficiencies in business processes, making it harder for owners to stay competitive.

- Innovation Stifling: Excessive regulation can sometimes dampen entrepreneurial spirit and slow down the implementation of innovative ideas.

Ultimately, these factors compel small business owners to develop careful strategies to manage regulatory demands while maintaining a focus on growth. Many are lobbying for clearer and more streamlined policies that support rather than hinder their operations.

Strategies for Thriving in a Challenging Environment

Given the mixed picture painted by the NFIB survey, it becomes clear that small business owners are in the midst of a transformational period. On one hand, there is an observable rise in optimism, fueled by better sales expectations and a cautious easing in supply chain disruptions and financing uncertainty. On the other hand, challenges such as labor quality issues, inflationary pressures, and persistent regulation woes remain a source of constant anxiety for many.

So what can business leaders do in response to these twists and turns? Here are several strategies that can help businesses continue to thrive:

- Embrace Technological Advancements: Leveraging technology to streamline operations, enhance customer relations, and improve supply chain management can help overcome many of the tricky parts of modern business.

- Invest in Workforce Development: Addressing labor quality means more than just raising wages. Training programs, enhanced benefits, and clear career paths can make a significant difference in attracting and retaining high-quality employees.

- Optimize Financial Management: With financing expectations gradually improving, it is essential to develop robust financial strategies. This includes better budgeting for capital expenditures, exploring new credit sources, and planning for unforeseen expenses.

- Streamline Compliance Processes: As tax and regulatory challenges persist, finding ways to simplify compliance can be a game changer. Automation of administrative tasks and seeking professional guidance can help reduce the burden.

- Develop a Flexible Pricing Strategy: With inflation remaining a key concern, adopting a flexible pricing strategy that takes customer sensitivity into account is important. Regular reviews of pricing, coupled with cost management strategies, can help maintain a balanced approach.

Employing these strategies can ease the overwhelming pressure of managing daily operations and planning for the future. Business owners who can figure a path through these tangled issues are likely to find success even in a market that remains full of challenges.

Analyzing the Long-Term Implications for Small Businesses

The August survey data not only shines a light on current sentiment but also provides a snapshot of the long-term trends that small business owners must consider. With optimism on the rise, there is cautious hope that the economic environment may gradually stabilize. However, several enduring challenges remain:

- Labor Market Dynamics: The difficulty in filling job openings and ensuring a steady supply of skilled workers continues to affect productivity. Addressing these issues will require both short-term fixes and long-term planning.

- Inflationary Pressures: Even with reduced price increases, inflation persists as a deterrent to growth and investment. Small business owners will need to focus on innovative cost-control measures while safeguarding profitability.

- Regulatory Environment: The impact of government regulations is unlikely to diminish quickly. A sustained dialogue between business owners and policymakers is needed to create a framework that supports growth and reduces operational friction.

- Capital Investment Uncertainty: While a higher percentage of businesses have recently invested in capital outlays, the pace of investment remains cautious. Economic shifts and technological disruptions could either spur further investment or render current plans obsolete.

Looking ahead, small businesses must be prepared to make their way through a landscape that is both promising and peppered with sudden shifts. The success of future growth will largely hinge on the ability to adapt quickly, develop resilient business models, and foster innovation even in the face of overwhelming, unpredictable market conditions.

Small Business Resilience: A Beacon for Future Growth

Despite the ongoing challenges, the overall sentiments expressed in the NFIB findings point to a resilient small business community. Many owners are using the current period of increased optimism as a springboard to drive further growth initiatives, invest in new technologies, and reimagine their customer engagement strategies.

Small businesses have historically been the backbone of the American economy. Their ability to weather difficult periods and transform challenges into opportunities is a cornerstone of economic progress. The slight increase in optimism, despite the nerve-racking issues related to labor quality and regulatory pressures, showcases the enduring spirit of these enterprises.

Elements of Small Business Resilience

Some core elements contributing to small business resilience include:

- Agility: The capacity to swiftly adjust business models, explore new markets, and pivot strategies is crucial during times of economic turbulence.

- Innovation: Small business owners are increasingly looking for creative solutions, whether it means adopting new technologies or rethinking traditional practices, to outmaneuver the extreme twists and turns of the current market.

- Community Engagement: Local partnerships, networking with fellow entrepreneurs, and leveraging community support can help build a stronger foundation for sustainable growth.

- Financial Prudence: Maintaining a careful balance between investing for growth and preserving liquidity is a key strategy to ensure continued stability amid financial fluctuations.

This combination of agility, innovation, and community spirit provides hope that small businesses will continue to thrive in the long run, despite the nerve-racking and off-putting challenges that still lie ahead.

Conclusion: Charting a Path Forward

In closing, the NFIB survey data from August offers a balanced picture of the state of small businesses today. On the positive side, there is a modest but meaningful rise in optimism, signified by improved sales expectations and a narrowing of uncertainties around financing and capital expenditures. However, significant challenges such as labor quality issues, inflationary pressures, and burdensome government regulations persist, demanding that business owners carefully figure a path through these tangled issues.

For those at the helm of small enterprises, the current environment calls for both caution and proactive planning. While the future holds promise, it is equally strewn with challenges that require persistent effort, creative thinking, and strategic adjustments. By embracing technological advancements, investing in workforce development, and streamlining financial as well as compliance practices, business owners can carve out a sustainable path forward.

As we witness these clear trends and subtle details emerge, it becomes apparent that the interplay between optimism and uncertainty is a driving force behind business transformations. The ability to work through, or manage your way, the evolving economic landscape will ultimately determine the resilience and success of small businesses in the coming years.

With the NFIB survey offering valuable insights, policymakers, industry leaders, and small business owners alike are encouraged to take these findings to heart. Open dialogue, innovative solutions, and adaptive strategies are all critical in turning today’s challenges into tomorrow’s opportunities. Despite being on edge in certain areas, the path ahead is filled with potential—and small enterprises across the nation are more than ready to take the wheel in steering their future.

Ultimately, the essence of small business resilience is not simply surviving the current climate but thriving amid it. As appearances of optimism grow, so too does the opportunity to redefine the small business landscape—making it more agile, competitive, and dynamic in meeting both present and future challenges.

Originally Post From https://americandrycleaner.com/articles/survey-small-business-optimism-improves-august

Read more about this topic at

Big, Beautiful Success Story: Small Business Optimism Hits …

NEW NFIB SURVEY: Small Business Optimism Rises