Defense Stocks and Shipping Titans: An Opinion Editorial

In today’s unpredictable market, investors are often left wondering how to figure a path through the twists and turns of the global economy. Recently, two very different sectors have been in the spotlight. On one side, there is a defense stock riding high on a major Air Force contract, while on the other, institutional moves in the shipping and maritime industry are sparking fresh debates. In this editorial, we’re going to dig into these developments, explore key trends that are super important for investors, and examine how these moves could affect overall market strategies.

Throughout this discussion, we’ll be touching on topics that impact everything from small business operations to industrial manufacturing, and even touch upon emerging trends in automotive and electric vehicles. The aim is to give you a comprehensive view of how different sectors are interlinked, how institutions are making their moves, and what that might mean for everyday investors.

Defense Stocks and Mega Military Contracts

One of the most striking developments in the defense industry recently has been the story surrounding a little-known underdog stock. The company in question secured a massive $4.3 billion Air Force contract, and while its name might not be on the lips of every investor yet, its performance signals a larger trend in the market.

Riding the Wave of Military Spending

Defense spending is no stranger to investors. The tricky parts of the defense industry often lie in understanding the complicated pieces behind government contracts, regulatory hurdles, and the fine points of budgeting processes. However, when a company signs on for a military contract of this magnitude, it tends to get a competitive boost that ripples throughout the market.

For investors, this kind of development might seem a bit overwhelming at first. There are several tangled issues to consider before jumping in:

- How secure is the contract in the long run?

- What kind of financial stability and cash flow does the company enjoy?

- How are shifting geopolitical trends influencing military budgets?

While these questions may appear intimidating, taking the time to get into the nitty-gritty details can reveal a powerful opportunity hidden within what might otherwise seem like nerve-racking news.

Understanding Defense Underperformers Turned Front-Runners

It’s interesting how companies that once flew under the radar suddenly become market darlings after landing a major deal. Investors have seen the benefits of getting into stocks before they become mainstream. In our case, the underdog stock benefiting from the Air Force contract is a prime example. Its rise shows the importance of keeping an eye on smaller defense firms that may be ripe for future expansion.

This isn’t just about chasing headlines; it’s about learning to steer through the confusing bits of the defense industry. When you dig into the company’s financial reports, you might find a mix of steady fundamentals and a promising future pipeline of projects. Often, these companies have laid the groundwork with sound engineering and technologies that set them apart from larger, more bureaucratic players.

Institutional Investments in the Shipping Sector

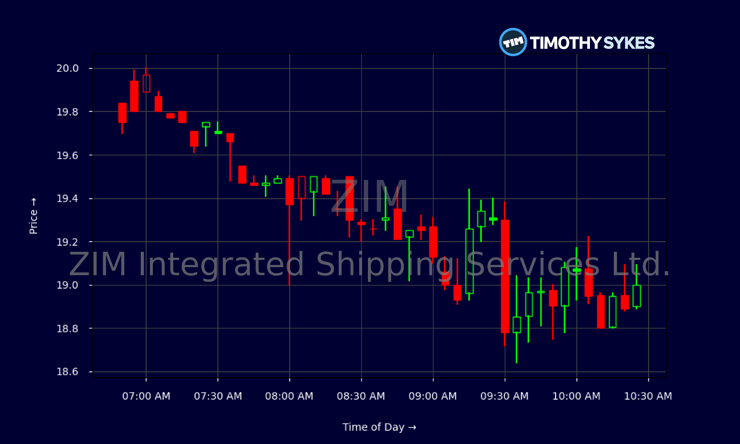

On another front, American Century Companies Inc. has recently notably increased its stake in ZIM Integrated Shipping Services Ltd. by a healthy 19.1%. With industry giants and seasoned institutional investors taking their positions, the shipping sector is currently generating plenty of talk on Wall Street.

Institutional Confidence and its Impact

Institutional investments are a super important signal in today’s market. When big names like American Century Companies and others boost their positions in a stock such as ZIM, it tells us that seasoned market players see potential amid all the controversial twists and turns of global shipping.

Some of the most telling bullet points include:

- American Century’s increased ownership now represents nearly 1.9% of ZIM’s stock, valued at around $33 million.

- Other institutional investors, such as Allianz and Citigroup, have also raised their stakes, indicating a broader vote of confidence.

- The shipping stock, despite missing some consensus estimates recently, still shows resilience with an impressive return on equity and net profit margins.

When analyzing such moves, it’s key to poke around past market patterns as well as look at the current economic conditions that may favor a rebound in shipping demand. The shipping sector has been on a roller-coaster ride, but these institutional moves highlight that there are hidden opportunities for those willing to get into the fine points of the market.

How Shipping Stocks Reflect Global Economic Trends

Shipping is an industry that is intricately linked with broader economic trends. From global trade volumes to changes in consumer behavior and even fluctuating fuel prices, there are many small distinctions that can impact a shipping company’s bottom line. ZIM Integrated Shipping Services, despite challenges like reduced earnings expectations, offers potential upside through dividend payouts and long-term revenue generation.

It’s essential for investors to figure a path through these slight differences. While there are some scary aspects, such as the company’s relatively low price-to-earnings ratio and the various financial measures that reveal slight vulnerabilities, many believe that the industry is just on the cusp of a bottoming trend. This is a space that is rich with potential if one is patient enough to steer through the nerve-racking short-term indicators and focus on the long-term growth drivers.

Connecting the Dots: From Defense to Shipping

While it might seem that defense stocks and shipping companies operate in vastly different realms, a deeper dive reveals connections between these two sectors. Both areas involve high capital intensity, are subject to extensive regulatory oversight, and often experience sudden market shifts that can catch even experienced investors off guard.

Tricky Parts of Cross-Sector Investing

One of the more challenging aspects of investing across different industries is getting around the subtle details that set each apart. For instance, the military contract secured by our defense underdog may be influenced by political and geopolitical factors that are rarely a concern for a shipping company. Meanwhile, shipping stocks are highly sensitive to global trade dynamics, which can be as unpredictable as the outcomes of defense bids.

To help organize these thoughts, consider the following table illustrating some of the key factors:

| Factor | Defense Stocks | Shipping Stocks |

|---|---|---|

| Market Drivers | Government budgets, military spending, geopolitical stability | Global trade volume, fuel costs, consumer demand |

| Risk Elements | Regulatory scrutiny, contract dependencies, political influences | Economic slowdowns, fluctuating freight rates, competition |

| Opportunities | Emerging technologies, streamlined supply chains, diversification into non-traditional markets | Recovery in global trade, diversification in service lines, strategic alliances |

This table underscores the fact that while each sector comes with its own set of overwhelming challenges, there are common threads. The need to poke around and get into the fine points of financial performance, strategic positioning, and market outlook is essential, regardless of whether one is investing in a defense firm or a shipping company.

Lessons for the Everyday Investor

For many small business owners and individual investors alike, these stories offer a broader lesson—one of the importance of keeping an eye out for opportunities that others might overlook. While the mainstream press may focus on well-known companies, the little details often hide significant chances to get ahead of the curve.

Here are a few takeaways that investors might find useful:

- Do Your Homework: Always take a closer look at a company’s balance sheet, cash flow, and future plans. Whether you’re looking at defense contracts or shipping dividends, understanding the hidden complexities is key.

- Spot Institutional Moves: When big investors increase their stakes, it’s usually because they see an edge that many have missed. Tracking these moves can help guide your decisions.

- Diversification is Essential: By spreading investments across different sectors, you manage to steer through the nerve-racking twists and turns of market volatility. It’s a strategy that small business owners and individual investors alike can benefit from.

- Be Prepared for Short-Term Fluctuations: Market sentiment can be tense in both defense and shipping sectors. Even promising companies may face temporary setbacks. Patience and a focus on long-term trends are critical in managing your portfolio.

Investors must learn to make their way through these tricky parts while keeping an eye on potential rewards. The strategies that work in one sector might inform decisions in another when you learn to read between the lines and figure out which trends are likely to have a lasting impact on profitability.

Economic Outlook and Broader Market Implications

The broader economic environment plays a super important role in shaping the fortunes of both defense and shipping firms. As government spending adapts to shifting geopolitical landscapes and global trade recovers from recent downturns, investors need to be agile and ready to adjust their strategies.

Government Budgets, Military Spending, and the Impact on Defense Stocks

Defense spending can be unpredictable, but it also offers opportunities when companies successfully secure large government contracts. The recent $4.3 billion Air Force contract, for example, demonstrates that innovative defense firms can punch above their weight. This kind of win not only boosts their visibility but also serves to reassure investors about the company’s long-term prospects.

Key points include:

- Stability Through Government Contracts: Government deals provide a steady revenue stream, even when market conditions are uncertain.

- Impact on Stock Valuations: When a smaller firm wins a substantial contract, its stock may experience a sharp increase, offering potential gains for early investors.

- Broader Policy Implications: Trends in military spending often reflect broader government policy. An increase in defense budgets can signal confidence in the nation’s security strategy, which benefits the whole industry.

Though it may seem intimidating to dive into these topics, even non-expert investors can learn to appreciate how government spending and military contracts can create opportunities in a sector that is, on the surface, full of confusing bits. A slight difference in perspective can be the key to unlocking value.

The Recovery in Global Trade and What it Means for Shipping

The shipping industry has been a roller-coaster ride over the past few years, with trade volumes fluctuating amid economic uncertainty and market tension. However, recent institutional investments suggest that there might be a bottoming trend in the sector—a sign that recovery could be on the horizon.

Things to consider include:

- Trade Volume Recovery: As global trade begins to bounce back from recent slowdowns, shipping companies are set to benefit from increased consumer and industrial demand.

- Dividend Payouts and Financial Health: Companies like ZIM have declared quarterly dividends, which, while modest, indicate that the firm is managing its finances carefully. In an industry where every percentage point matters, this is a promising sign.

- Institutional Endorsement: When heavyweight investors increase their stakes, it confirms that there are legitimate opportunities hiding within the fine details.

Investors should stay alert as the shipping sector may need a while to fully recover from the shock of global market disruptions. In the meantime, even small investments in a potentially rebounding market can offer attractive returns if you have the patience to see the changes through.

Small Business, Industrial Manufacturing, and the Bigger Picture

These market developments aren’t isolated events tested only on high-stakes stocks and large contracts. They’re part of a much larger picture—a picture that affects small businesses, industrial manufacturing, and even emerging sectors like electric vehicles and automotive industries.

How Industrial Manufacturing Mirrors Defense and Shipping Trends

Industrial manufacturing is at the core of many of these stories. When a defense contractor lands a major deal or a shipping company recovers from market pressures, the benefits often extend to the supply chains that support these industries. Small business owners in manufacturing frequently experience the following:

- Increased Orders: Major contracts often lead to increased demand for parts, equipment, and logistical services.

- Supply Chain Benefits: As larger companies ramp up production, small and medium suppliers see a boost in business, helping to stabilize local economies.

- Innovation and Technology Adoption: Successful firms invest in innovative solutions to meet high standards, which can trickle down to benefit industrial manufacturing as a whole.

Understanding these intertwined relationships helps clarify why investments in seemingly niche areas, whether defense or shipping, can spur broader economic growth. By taking a closer look at these sectors, you can appreciate how even small businesses stand to benefit and why it’s important to keep track of the subtle shifts happening across the industry landscape.

Business Tax Laws and Their Influence on Market Dynamics

Another layer that can’t be ignored is the role of business tax laws. Changes in tax legislation can directly affect the profitability of defense contractors, shipping companies, and manufacturers alike. For example, tax incentives for innovation may provide a much-needed boost to firms investing in new technologies or energy-efficient operations.

Key considerations include:

- Tax Incentives: These can encourage companies to commit to longer-term projects by easing some of the financial burdens associated with major capital expenditures.

- Regulatory Clarity: Clear and stable tax laws reduce the nerve-racking uncertainty that can derail long-term planning and investment.

- Impact on Dividends and Shareholder Value: Favorable tax policies often translate into healthier balance sheets and the potential for increased dividend payouts, which can drive investor confidence.

As both defense and shipping companies evaluate their future plans, tax laws are among the many subtle details that influence outcomes. For the savvy investor, keeping an eye on these changes—no matter how off-putting the tax code text might seem—can be an essential part of your overall strategy.

Emerging Trends: Electric Vehicles, Automotive, and the Future of Manufacturing

While the current discussions on defense and shipping are indeed compelling, it’s important to situate these developments within the broader context of economic evolution. A surge of investment in electric vehicles (EVs) and innovation in the automotive sector signal a future that is brimming with opportunities—and challenges. These trends may seem unrelated to defense contracts or shipping dividends, yet they share many common threads.

The Growing Overlap Between Traditional Industries and New Technologies

The automotive industry, particularly in the realm of electric vehicles, is a story of transformation. Traditional manufacturing and assembly methods are giving way to innovative, tech-driven processes. This presents a number of confusing bits and complicated pieces for investors to sort out:

- Investment in Technology: Automotive firms are channeling huge sums into R&D, leading to breakthroughs that could redefine energy efficiency and performance.

- Supply Chain Transformations: Much like in defense and shipping, the small details—whether it’s battery technology or advanced robotics—play a key role in maintaining a competitive edge.

- Policy and Regulation: Government incentives and stringent emissions standards are guiding the market, much like defense contracts are influenced by national security needs.

For investors, understanding these fine shades of difference is crucial. The companies that manage to merge traditional expertise with modern technology tend to stand out. Whether you’re looking at an EV manufacturer or a defense contractor with a cutting-edge technology division, the ability to blend legacy strengths with innovative ideas is often the dividing line between lasting success and short-lived hype.

Parallel Paths: How EVs and Shipping/Defense Can Inform Each Other

At first glance, electric vehicle manufacturers might seem to have little to do with shipping companies or defense firms. Yet the parallels are striking. All these industries require significant investments in infrastructure, R&D, and talent development. Moreover, they are all sensitive to both domestic policy shifts and international market trends.

For example, just as a shipping company might strategically use dividend payouts to allure investors during a tentative economic rebound, an automotive firm may use government incentives to ease the nerve-racking costs associated with new technology adoption. The overlap provides a rich tapestry of market dynamics, where even the smallest twist or turn could have broader implications than it appears at first glance.

Financial Health and Market Ratios: A Closer Examination

No opinion editorial on investments is complete without a discussion on the key financial metrics that drive market decisions. When comparing defense stocks and shipping firms, it is essential to dive in and take a closer look at several indicators that reveal a company’s financial strength.

Key Performance Indicators to Watch

Below is a table highlighting some of the critical indicators investors should consider when evaluating companies in both sectors:

| Indicator | Defense Industry Focus | Shipping Sector Focus |

|---|---|---|

| P/E Ratio | May be higher due to growth potential from large contracts | Often lower, reflecting market pressure and cyclical performance |

| Dividend Yield | Generally modest, reinvestment in R&D is prioritized | An attractive yield can be a key draw for income-focused investors |

| Return on Equity | Can signal strong management and effective contract execution | High figures may reflect resilience even amidst economic downturns |

| Debt-to-Equity Ratio | An indicator to watch for potential financial strain during project cycles | Important for assessing how leveraged a company is amid market fluctuations |

Keeping tabs on these numbers can help investors work through the nerve-wracking reports and make informed decisions. Equally important is reading the fine print in financial statements, where many of the little twists and hidden complexities reside.

Using Quantitative Tools to Find Your Way

For those of you less inclined to parse through dense financial reports, several online tools and calculators can simplify your search. These may include:

- Dividend Yield Calculators: Handy for determining the income potential of a stock.

- Market Cap Comparison Tools: Help you understand a company’s size relative to its peers.

- Financial Ratio Screeners: Assist in filtering out stocks that meet your specific criteria.

Using these tools allows you to zoom in on the subtle parts of financial performance, helping you decide whether a stock is both undervalued and positioned for long-term growth.

Marketing and Media Coverage: The Role of Public Perception

In the modern market, how a company is portrayed in the media can be almost as critical as its financial performance. Media narratives not only influence public sentiment but can also alter the market environment.

The Impact of Media Buzz on Defense and Shipping Stocks

We’ve seen headlines proclaiming “Defense Underdog Rides a $4.3B Air Force Contract” and sizable institutional moves in shipping stocks. While these headlines certainly capture attention, they can also create a set of tricky expectations for investors. It’s crucial to take a closer look at the actual performance details rather than get swept up in hype.

Here are a few ways media coverage can influence investments:

- Investor Sentiment: Positive buzz can drive up stock prices, sometimes out of proportion to underlying fundamentals.

- Market Volatility: Overhyped news can lead to quick sell-offs once the initial excitement fades, creating a tense and on-edge market environment.

- Long-Term Perspective: Savvy investors tend to focus on the key details—dividend payouts, contract security, and financial stability—rather than the fleeting buzz.

In other words, while publicity is critical, the need to steer through the fine details of company performance and broader market trends cannot be understated. This balanced view helps in managing risk and ensuring that decisions are based on solid information rather than just market hype.

Conclusion: Strategies for a Diverse Portfolio in Uncertain Times

The stories unfolding in both the defense and shipping sectors underscore an important message for all investors: diversification and careful analysis are must-have strategies in today’s market. Whether you’re a small business owner looking to maximize your personal savings or an institutional player managing large portfolios, understanding the underlying factors at play can help you make informed decisions, even when the current market appears intimidating.

To wrap up, here are some final thoughts to keep in mind:

- Stay Informed: Market conditions are continuously evolving. Make sure you get into the habit of regularly reviewing financial news, sector analyses, and earnings reports.

- Analyze with a Long-Term View: Short-term volatility is inevitable. Focus on sustainable growth drivers like government contracts in defense or the gradual recovery in global shipping.

- Diversify Your Investments: Spreading out investments across multiple sectors can help balance out the nerve-wracking moments, ensuring that a slump in one area doesn’t overly impact your entire portfolio.

- Use Tools to Simplify Complex Data: Financial calculators, ratio screeners, and up-to-date research tools are your friends when it comes to navigating the tangled issues of today’s markets.

In a world where every sector—from defense and shipping to industrial manufacturing and electric vehicles—shares common challenges and opportunities, the key to success lies in staying curious, keeping informed, and not being afraid to dig into the little details. Even if the market is packed with intimidating twists and turns, those who take the time to poke around, figure a path through the subtle details, and manage their way with a diversified strategy will likely end up in a far better position in the long run.

Ultimately, whether you’re drawn to the promise of a formidable military contract or the emerging potential of a shipping company gradually reclaiming its momentum, financial success isn’t determined by a single headline. Instead, it is the result of rigorous research, patience, and a willingness to work through the confusing bits that make every market unique.

By keeping a balanced perspective, considering both the strong fundamentals and the minor setbacks, and using sound judgment to sift through the nerve-racking market sentiment, investors can uncover genuine opportunities that are ripe for the picking. So, as you chart your own investment journey, remember that it isn’t just about riding one sector’s wave—it’s about building a resilient, well-rounded portfolio that’s engineered to thrive across the myriad challenges and exciting possibilities of our modern economy.

In these uncertain times, whether the focus is on defense, shipping, or emerging industries like electric vehicles and high-tech manufacturing, the ability to read between the lines and appreciate both the big picture and the finer details is a quality that every investor should nurture. After all, the road to prosperity might be full of tricky parts and overwhelming moments, but with careful planning and a diversified approach, every challenge presents an opportunity for those who are ready to take the wheel and steer through the ride.

Originally Post From https://www.marketbeat.com/instant-alerts/filing-american-century-companies-inc-purchases-366205-shares-of-zim-integrated-shipping-services-ltd-zim-2025-08-22/

Read more about this topic at

Atlanta Falcons Dee Alford Went from Underdog to …

If you have questions on how to use Catalyst, please ask …