The UK’s Steel Safeguard Decision: A High-Stakes Gamble with the Steel Ecosystem

The recent adjustments to the UK’s steel safeguard measures have stirred significant debate among industry players. This op-ed examines the government’s accelerated quota cuts and its rippling impact through the entire steel value chain. It is a call to carefully weigh the quick fixes against the tricky parts of supply chain logistics, economic competitiveness, and operational stability in one of the nation’s core manufacturing sectors.

Understanding the Steel Market Dynamics

The steel industry, being on the front line of industrial manufacturing, is replete with tricky parts and tangled issues that affect both producers and downstream businesses. At its heart, the steel market operates on a delicate balance of supply, demand, and regulatory controls. Any adjustments to safeguard measures require meticulous planning to avoid unintended consequences.

Key aspects include:

- Supply Chain Synchronization: Coordinating shipments, port handling, and timely deliveries are essential to keep production on track.

- Market Stability: Price fluctuations can lead to nerve-racking uncertainties for businesses operating on tight margins.

- Global Trade Pressures: International market trends and trade policies, which are full of problems and on edge, often impact domestic regulations.

This complex ecosystem calls for an understanding of the little details and subtle parts that define the steel market’s functioning and resilience. Without addressing these hidden complexities, any policy shift risks upsetting a system that many believe is already loaded with challenges.

UK Government’s Rapid Quota Cuts: The Rollout and Its Repercussions

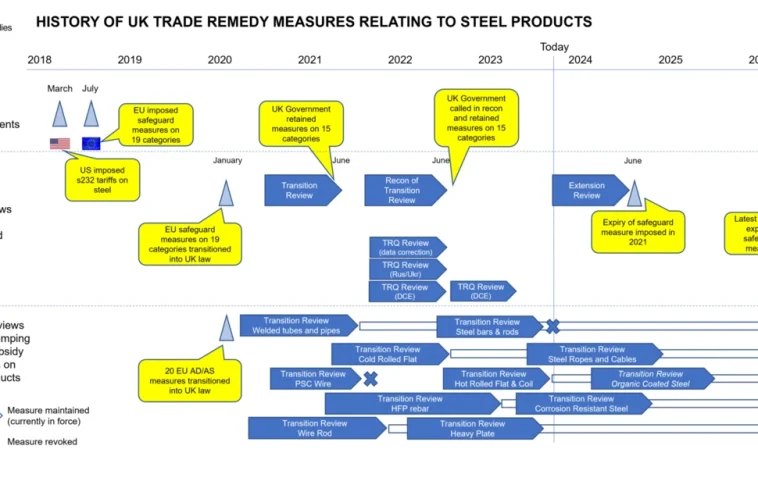

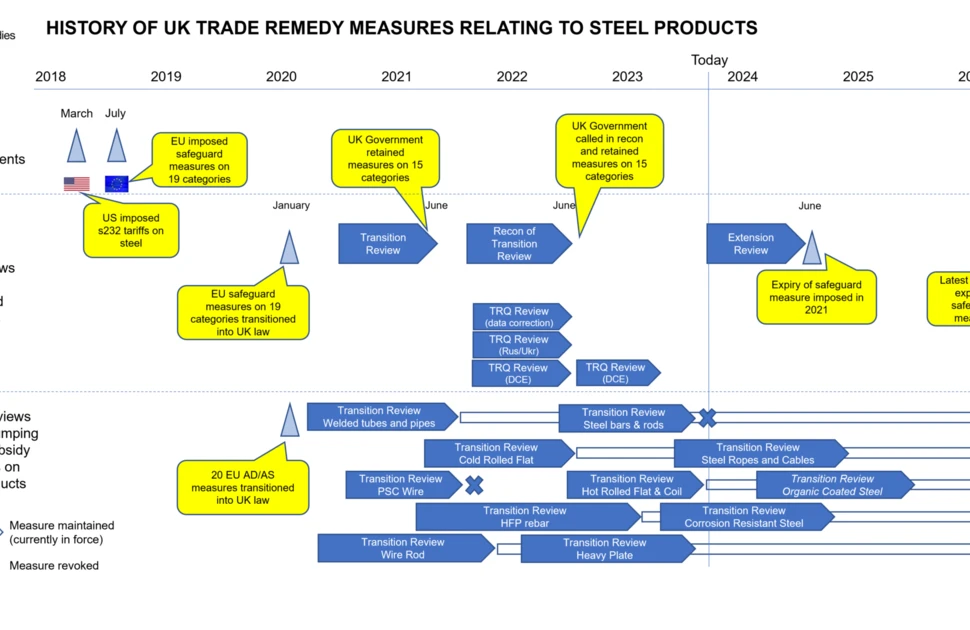

In a move that caught many by surprise, the UK government overrode the recommendations from the Trade Remedies Authority, slashing safeguard quotas from 70 percent to merely 15 percent for certain countries. Even more striking was the decision to move the enforcement date from the recommended October timeline to July 1. This early implementation has sparked port delays, import suspensions, and delivery disruptions that are now echoing throughout the supply chain.

These sudden changes have created a cascade of logistical challenges that companies have found difficult to manage. Key concerns include:

- Severe Supply Chain Disruptions: With vessels diverted to alternative ports, companies are experiencing delivery delays of at least four weeks.

- Higher Operational Costs: The abrupt changes have triggered increased expenditure due to rerouted logistics and expedited shipping needs.

- Risk to Downstream Industries: Manufacturers relying on timely imported steel now face the prospect of production delays, threatening established contracts and revenue streams.

Even when viewed against the backdrop of an effort to protect domestic steel production, such a drastic timeline has proven to be more damaging than beneficial. Critics argue that such measures have not only created a nerve-racking environment for businesses that are already struggling with operational uncertainties but have also introduced a domino effect that could destabilize the entire sector.

Behind the Curtain: How Supply Chain Challenges Are Unfolding

The supply chain in the steel industry is notorious for its complicated pieces and subtle issues that can trip up even the most experienced operators. The early enforcement of new quotas has exacerbated these issues, making it more complicated for companies to figure a path through the maze of new regulations.

Let’s take a closer look at some of the critical supply chain challenges:

| Challenge | Description | Impact |

|---|---|---|

| Port Congestion | Unanticipated high volumes of diverted shipments leading to delays. | Increased turnaround times and higher storage costs at ports. |

| Logistical Rerouting | Vessels rerouted to alternative ports not fully equipped for high throughput. | Additional handling costs and potential quality assurance issues. |

| Operational Uncertainty | Manufacturers are forced to adjust order schedules on short notice. | Production bottlenecks and potential accumulation of inventory costs. |

These problems are not trivial. They require both immediate tactical responses and longer-term strategic planning to ensure that the steel ecosystem remains robust. The current scenario leaves many companies struggling to get around the confusing bits of the new arrangements and calling for urgent government intervention to smooth out the issues.

Decoding the Domino Effect on Downstream Industries

The repercussions of the new safeguard measures extend far beyond primary steel production. Downstream industries that rely on a steady stream of steel for manufacturing consumer goods, automotive components, and industrial equipment are now grappling with significant operational delays and escalating costs. This ripple effect highlights the need to consider the entire value chain when implementing regulatory changes.

Some of the key concerns raised by affected downstream industries include:

- Production Interruptions: Unexpected delays in steel deliveries can stall assembly lines, leading to missed deadlines.

- Increased Costs: Rerouting and expedited logistics come at a premium, adding extra layers of cost.

- Market Instability: These operational challenges contribute to a volatile market environment where even minor disruptions can lead to significant financial repercussions.

Industry advocates have called on policymakers to steer through these challenges by adopting a more measured approach. They suggest that aligning enforcement timelines with industry recommendations could help manufacturers get into a smoother adjustment process, thereby mitigating some of the immediate risks associated with the rapid policy shift.

Balancing Producer Protection and Downstream Stability

The core of the debate over the recent safeguard measures lies in the attempt to protect domestic steel producers while inadvertently putting downstream industries at risk. Though the intention behind the policy is to shield local production from international price undercuts, the execution appears to have overlooked the following critical points:

- Preparation Time: The TRA had recommended an October implementation to give businesses enough time to adjust their operations and supply chains.

- System-Wide Implications: While producers may benefit from reduced competition, downstream companies that depend on timely inputs face serious disruptions.

- Economic Trade-offs: The additional costs incurred by supply chain disruptions could negate any potential benefits for domestic steel manufacturers.

Critics argue that a more balanced approach is essential—a strategy that supports both producers and the broader manufacturing ecosystem. This would involve a comprehensive review of the entire value chain, ensuring that safeguards do not simply shift the burden from one sector to another.

Managing the Path Through Policy Changes and Supply Chain Disruptions

It is super important to recognize that change, even when implemented with good intentions, can be off-putting if it is not managed correctly. The rapid quota cuts have thrown many companies off balance, making it a nerve-racking time for those trying to untangle the knots of new regulations. To mitigate further disruptions, several strategic recommendations have been advanced:

- Staggered Implementation: Introducing policy changes gradually over time could help companies adjust without overwhelming them. A phased approach would allow time to adapt, test new procedures, and minimize the risk of system-wide shock.

- Enhanced Communication: Establishing direct channels of communication between government bodies, industry representatives, and logistical operators can help anticipate and resolve issues before they become critical. Transparent discussions and feedback mechanisms are key to addressing small distinctions in policy impact.

- Collaboration with Stakeholders: Involving a wide range of industry players in the decision-making process ensures that guidelines are realistic and inclusive of various operational needs. This sort of investment in relational dynamics can help diffuse tension and create a more resilient supply chain.

These recommendations, if implemented, could help figure a path through the maze of current challenges and create a more sustainable policy framework going forward. It is critical for policymakers to dive in and take a closer look at the potential long-term implications of regulated quota reductions.

Comparative Analysis: Global Perspectives on Steel Safeguards

Looking at international approaches to steel safeguard measures reveals that while protectionist policies are not new, the methods of implementation vary considerably. Some countries have adopted more gradual changes that allow for logistical adjustments, while others have faced similar criticisms over abrupt timeline shifts.

Consider the following comparative points:

| Country | Implementation Style | Outcome |

|---|---|---|

| USA | Phased approach with industry consultation | Smoother transitions with minimal supply chain disturbances |

| EU | Staggered enforcement with periodic reviews | Balanced protection with collaborative stakeholder input |

| India | Aggressive safeguard measures but gradual adjustments where possible | Initial disruptions gradually mitigated through adaptive logistics |

The UK’s decision, in stark contrast, has been characterized by a more rushed rollout. Industry experts suggest that adopting best practices from these global perspectives could help address some of the current issues. The lessons are clear: while protectionist steps might offer short-term relief for domestic producers, their effectiveness ultimately depends on the timely and coordinated adjustments across the entire supply chain network.

Evaluating the Impact on Small Businesses and Local Economies

Beyond the immediate industrial implications, the ripple effects of the steel safeguard measures touch even the smallest of local enterprises. Many small businesses, particularly those operating as suppliers or service providers along the steel assembly line, find themselves caught in a bind between increased costs and unpredictable timelines. This group is often less equipped to handle the rapid twists and turns that come with abrupt policy shifts.

Particular challenges for small businesses include:

- Cash Flow Constraints: Sudden delays in receiving products or materials can lead to cash flow issues that threaten even the viability of local operations.

- Reliance on Timely Deliveries: Smaller companies tend to operate with lean inventories. A delay of even a few weeks can cause significant production interruptions.

- Limited Bargaining Power: Unlike large manufacturers, small businesses may not have the leverage to demand expedited logistics or negotiate better terms amidst regulatory shifts.

Given these concerns, there is a strong argument for policies that are sensitive not only to the needs of large industrial players but also to the small business community. Making incremental changes that allow time for adjustment can help mitigate the nerve-racking uncertainties that many of these businesses face in the wake of sudden policy changes.

Policy Implications: Suggestions for a More Equitable Framework

Regulatory bodies can take several steps to ameliorate the impact of abrupt safeguard measures. To protect both the producers and the downstream businesses that rely on steady steel supplies, it is key to incorporate a broader spectrum of voices and data points into the policymaking process. The following strategic actions could help forge a more balanced pathway forward:

- Integrated Stakeholder Consultations: Involve representatives from the steel production nexus to the local SMEs in consultations. By collecting input from logistics experts, port operators, and manufacturing outlets, policymakers can gain a clearer picture of where conflicts and delays might emerge.

- Extended Transition Periods: Allowing more time for businesses to adjust to new quotas can prevent the emergence of the domino effect we have witnessed. Such an approach can help ensure that the heavy lifting associated with rearranging supply chains is distributed over a more manageable timeline.

- Real-Time Data Sharing: Investing in platforms for real-time tracking and data sharing between public authorities and private entities can help smooth over tangled issues as they develop. This collaborative strategy is an essential tool for managing your way through dynamic market conditions.

- Long-Term Strategic Reviews: Instituting periodic reviews of the safeguard mechanism can help assess its overall impact and allow for mid-course corrections before the system becomes overly stressed.

Moving forward, these suggestions must be balanced against the promise of enhanced protection for domestic industries. However, it is super important that the measures do not come at the expense of stability and predictability across the wider value chain.

Digging Deeper into the Sector: Interviews and Industry Voices

Prominent industry voices, such as Stephen Morley, president of the Confederation of British Metalforming, have warned that the accelerated timeline for quota implementation gives little room for companies to prepare. According to such experts, the early enforcement timeline has effectively triggered a domino effect—one that is loaded with issues and generating widespread concern about future operational stability.

Industry interviews highlight several recurring themes:

- Uncertainty: Many business owners express anxiety over the sudden shift, as even minor disruptions now can lead to significant operational and financial losses.

- Cost Increases: Companies report that diverted shipments and port delays result in escalated logistics costs, further straining tight profit margins.

- Call for Revised Policy: Stakeholders consistently recommend a re-evaluation of the accelerated timeline, arguing that a more systematic implementation process would better serve the industry’s long-term interests.

These multiple viewpoints suggest that a more inclusive and deliberative policy-making process is needed—one that dig into the fine points of supply chain management and considers both immediate and long-term risks. The current situation, as outlined by industry experts, serves as a cautionary tale of how short-term objectives can sometimes be at odds with ensuring a smooth, sustainable industrial environment.

Looking Ahead: The Future of Steel Markets in a Changing Landscape

As the implementation of the safeguard measures unfolds, stakeholders across the steel market are keeping a close eye on the evolving situation. With global pressures, shifting trade relationships, and domestic economic challenges, many question whether the current approach will ultimately benefit the broader industrial ecosystem—or if it will prove to be a high-stakes gamble with far-reaching repercussions.

Key future trends to watch include:

- Policy Revisions: Ongoing reviews and stakeholder feedback could prompt adjustments to the enforcement timeline and quota figures.

- Supply Chain Innovations: Companies may invest in more resilient logistics and data-sharing systems to better manage unexpected twists and turns.

- Market Consolidation: As smaller players struggle with increased costs and uncertainties, larger firms might consolidate their market positions, potentially altering competition dynamics.

Emerging global trends also indicate that industries around the world are grappling with similar issues. For example, protective measures in other markets are often paired with technology investments that improve supply chain visibility and efficiency. Adapting these best practices could allow the UK to not only stabilize its domestic market but also maintain a competitive edge in the global arena.

Practical Steps for Industry Players: A Checklist for Adjusting to New Policies

For manufacturers, logistical operators, and small-scale suppliers trying to steer through the current climate, a practical checklist can be invaluable. Here are some steps that companies can consider:

- Review Your Supply Chain: Identify choke points and evaluate alternative routes to mitigate the risk of port delays and shipment diversions.

- Adjust Inventory Management: Consider increasing the safety stock or diversifying suppliers to cushion the impact of potential delivery disruptions.

- Strengthen Communication Channels: Establish robust lines of communication with logistics partners, government authorities, and industry associations to receive timely updates.

- Monitor Policy Developments: Stay informed about policy reviews and amendments that may affect enforcement timelines or quota levels.

- Embrace Technological Solutions: Invest in real-time tracking systems and data analytics to get around or figure a path through sudden changes in the supply chain.

This checklist provides a starting point for companies facing the nerve-racking challenge of adapting to sudden regulatory shifts. Tailoring these practical steps to individual circumstances can help mitigate risks, ensuring smoother operations even in a turbulent policy environment.

Conclusion: Striking a Delicate Balance in a Changing Order

The recent steel safeguard decision by the UK government has brought to light the intricate and interconnected nature of the nation’s industrial ecosystem. While the measures were implemented with the aim of bolstering domestic production, the hurried timeline and unforeseen supply chain ramifications have spotlighted the hidden complexities within the industry.

From examining the fine points of supply chain management to reflecting on both global and local perspectives, it is evident that policy changes of this magnitude require more than a one-size-fits-all approach. The current scenario is a reminder that every regulatory tweak can have a domino effect—impacting not only large manufacturers but also small businesses and the broader economic landscape.

Ultimately, a successful policy approach must balance short-term protections with long-term stability across the entire steel ecosystem. Engaging in open dialogue, investing in technology, and incorporating a phased implementation strategy can help smooth out the rough edges of these transitions. If government bodies and industry stakeholders can come together to take a closer look at the subtle parts of the current challenges, a more resilient and adaptive framework may yet emerge—one that welcomes both the domestic steel producers and the businesses that rely on their output.

The future of the steel market in the UK hinges on finding that delicate balance. By carefully negotiating the twists and turns inherent in supply chain logistics and industrial policy, the nation can aspire to not only protect its industries but also foster an environment where every link in the chain flourishes. The stakes are high, and the path forward is full of challenges, but with collaborative effort and thoughtful adjustments, a more sustainable and secure steel ecosystem is within reach.

Originally Post From https://www.steelorbis.com/steel-news/latest-news/cbm-slams-uk-steel-safeguard-decision-over-quota-cuts-and-supply-chain-risks-1405653.htm

Read more about this topic at

Safeguarding the energy transition against political …

Countermobilization Policy Feedback and Backlash in a …